Interpreting VC data for 2023

First semi-serious post, so will be throwing a bunch of data points to set context for subsequent posts. TIA!

2021 and the euphoria in the venture world seems like a long time away. The sentiment today could not be farther from the stratospheric peaks for Nov-2021, and closer to the reality. And it took us five quarters of protracter contractions in venture funding, valuations and pace of capital deployment to get to this point.

Fundraising is difficult in general, and with the extra emphasis on startups needing to showcase a clear path to profitability, and more importantly, sensible and credible growth plans - it has gotten a whole lot tougher! There is nowhere to hide for many founders, and folks who raised from some of the larger venture funds purely on their confidence in the team and no underlying business fundamentals in 2021 are struggling to grow into those valuations today.

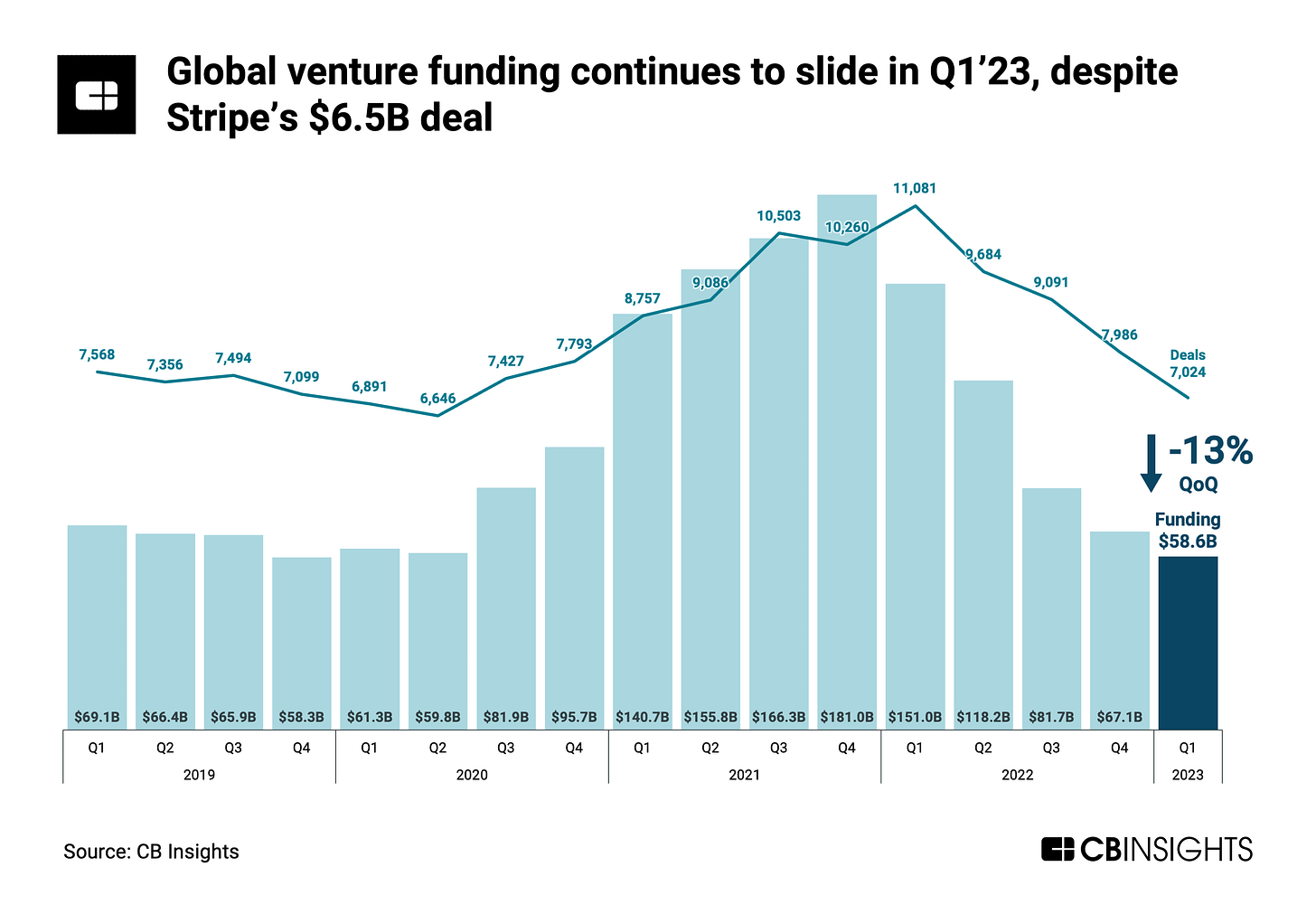

Over the last 5 quarters, global venture funding have declined by more than two-thirds, from a whopping $181B in the last quarter of 2021 to just over $58B in Q1’23 as per the CBInsights data below.

SaaS continues strong traction

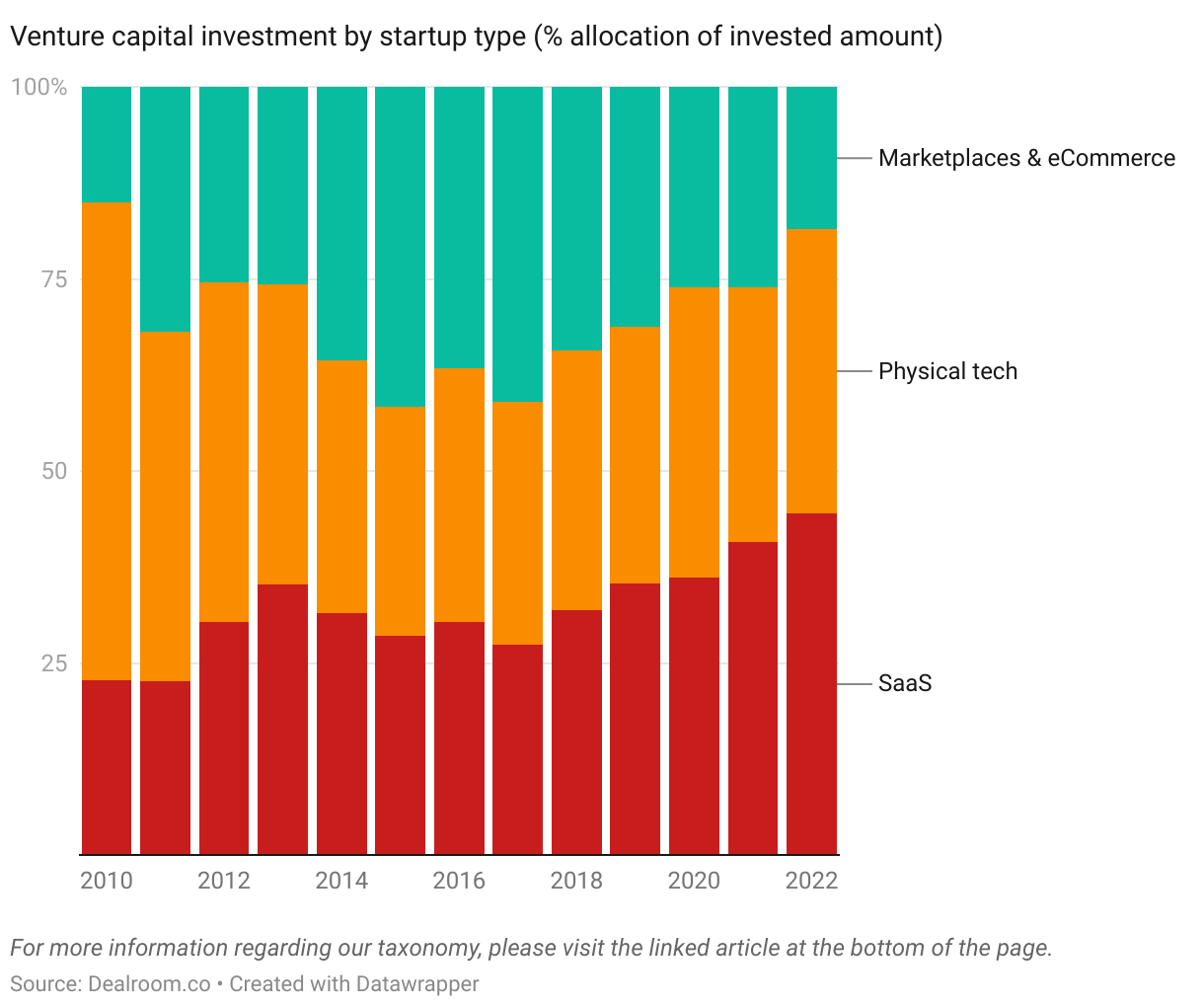

Continuing the trend of the last decade, software-as-a-service (SaaS) had the largest share of all venture funding globally according to data from Dealroom. SaaS has now reached critical mass, with it not being only a solution for cloud-native, digital-first organisations who have always been early adopters but also being adopted actively by larger, more traditional (aka digital laggard) customer accounts.

Sectors such as manufacturing, construction, logistics and other physical sectors are seeing increasing profileration of vertical SaaS solutions to improve efficiency for businesses, employees, supply chain partners and other stakeholders. Case in point - Planera’s $5.4M seed round. We will continue to see more verticalisation of software with end-to-end optimised solutions being preferred by customers as opposed to running multiple horizontal plays and creating unncessary siloes.

SaaS share of overall venture funding stood at 45% in 2022, up from nearly 27% of overall VC dollars in 2017. That translates into a 27% annualized growth rate on a technology that received $227B in funding last year! I don’t think SaaS as an opportunity is not going away soon, despite the calls from people on excessive SaaS. I think Hiten Shah captures it well in a recent The Startup Chat episode about the ease of building a SaaS product today, and the need for more SaaS as well.

Physical tech + Hardware seeing revival

What excites me beyond the obviously potential of SaaS (80+% gross margins, 30+% EBITDA margins, rapid scale once you crack GTM motions - VCs love this) is the resilince and the resurgence of physical tech investments. As an engineer by academic training, I have a soft spot for hard-tech solutions solving the hardest of problem statements such as Agritech, Climate Tech, Warehouse & Supply chain Tech, Healthtech and many more areas.

While the Dealroom data for physical technology only defines it broadly as startups producing atoms over bits, areas such as healthtech, energy, transportation, robotics are at the forefront for this decade. With the kind of supply chain stresses resulting from COVID-19 lockdowns and the resulting acute labour shortages post re-opening of economies, businesses are looking to technological advancements in software and/or hardware solutions to ease more pressure on their operations.

Exits within deep tech / hard tech / physical tech have largely been far and few last decade and the space was a niche on its own within the VC class. With the kind of tailwinds we are seeing today, I strongly believe we will see phytical tech opportunities become mainstream with active primary transactions across stages (like pi Ventures, MFV Partners, Speciale Invest, and many others!), as well as a thriving secondary market for these opportunities from corporates as well as funds.

Marketplaces need first-principles reimagining

The third segment, marketplaces, seem to have fallen out of favour with a number of investors over the last 5 years. Their share of overall funding has declined from 41% of all VC dollars in 2017 to 19% last year. There was also a decline in absolute VC dollars invested in marketplaces, with $101B in 2017 and $92B in 2022. A large reason for the tepid demand in marketplaces has been the shift in focus from a GMV-led valuation approach to either multiples on net-revenue or EBITDA. Businesses need to make money after a certain point, and GMV-based multiples for a Series D+ round fails to make sense for prudent investors.

I was chatting with a friend who works at one of the world’s largest marketplace, and he joked that his target for the month is break-even at best. That is a low-bar even at the scale of a few billions in annual GMV, and that is the problem with marketplaces today. Most marketplaces inherently do not have a sufficient business moat, with the same sets of sellers and buyers frequenting multiple platforms prior to a purchase decision.

A recent Think with Google note on the future of retail has some fascinating insights into the world of e-commerce. The next gen of marketplaces will be able to solve for the problem of customers ‘shopping around’ by helping sellers streamline their business operations (sourcing, production, financing etc.) and buyers access more personalized, curated deals (real-time price discovery, truly personalized recommendations - with the explosion of individual metadata this should be more possible today, seamless omnichannel experiences, loyalty & subscription programs, other value-based add-ons) to improve their conversion rates.

AI will be the most exciting space!

Finally, we are entering the age of AI. Artificial Intelligence on its own will continue to manifest into an multi-billion technology opportunity. While software solutions built on GPT rails will continue to dominate, hardware solutions such as semiconductor chips etc will also grow strong. Nvidia’s H100, which was launched in summer 2022, became an overnight luxury good after the launch of ChapGPT in Nov-22. And the demand thereafter for processors capable of running GenAI and the associated compute has driven Nvidia to the coveted $1trillion market cap status.

With the rise of GenAI, what truly excites me is the potential of running these workloads and compute operations in a distributed and decentralized manner. That has the potential to drastically reduce the server and hardware infra costs needed to be shelled out upfront to run ops. Might be a bit far-fetched today, but something I will continue to keep an eye on for the future!

Let me know if you agree/disagree - would love to learn new perspectives and any contratian views on where the world is heading.

Thanks for the read, and follow me here for more!